Report of the Auditor General of Canada to the Board of Directors of Canada Lands Company Limited—Special Examination—2024

Independent Auditor’s Report

Table of Contents

- Audit Summary

- Introduction

- Findings, Recommendations, and Responses

- Conclusion

- About the Audit

- List of Recommendations

- Exhibits:

- 1—The corporation’s properties across Canada include both attractions and real estate

- 2—Corporate governance—Key findings and assessment

- 3—Strategic planning—Key findings and assessment

- 4—Corporate risk management—Key findings and assessment

- 5—The corporation owns and develops a variety of real estate properties across Canada

- 6—The corporation owns and operates 4 attractions in Ontario and Quebec

- 7—Real estate—Key findings and assessment

- 8—Attractions—Key findings and assessment

- 9—Environment and sustainable development—Key findings and assessment

Audit Summary

We found no significant deficiencies in the corporate management practices or the management of operations of Canada Lands Company Limited during the period covered by the audit. However, we found opportunities for improvement in the areas of board oversight; asset optimization; performance measurement, monitoring, and reporting; risk identification and assessment; and attractions planning. Despite these weaknesses, the corporation maintained reasonable systems and practices for accomplishing its mandate.

Introduction

Background

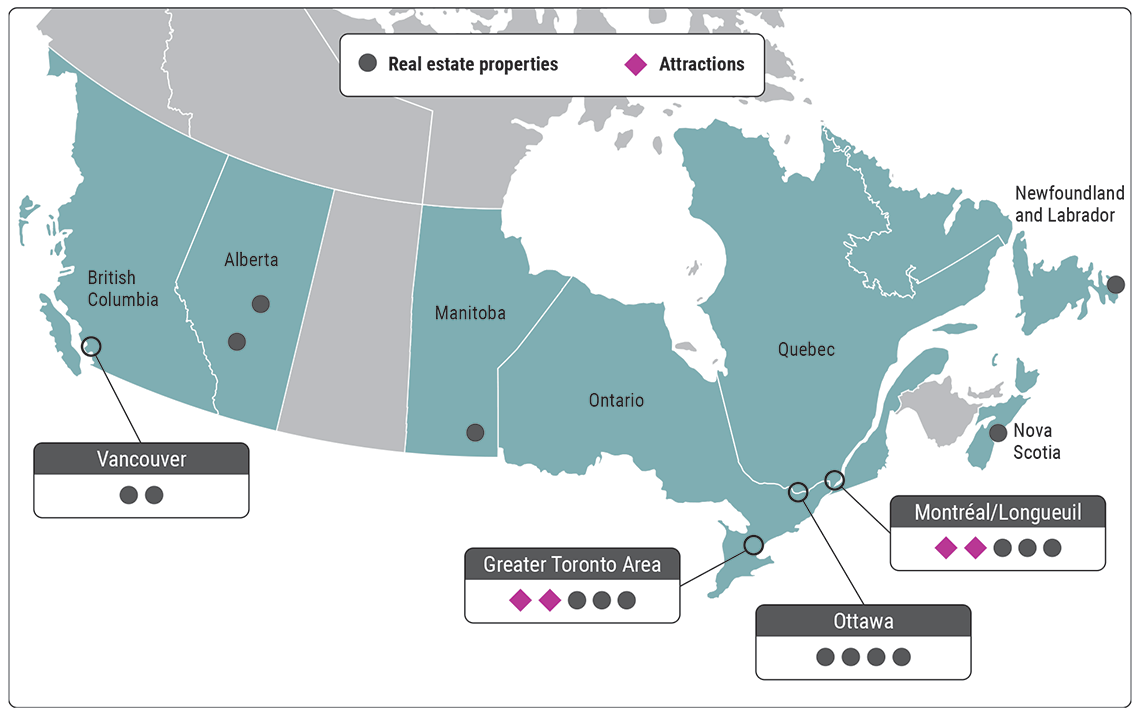

1. Canada Lands Company Limited is a Crown corporation listed in Part I of Schedule III of the Financial Administration Act. The corporation develops and sells strategic real estate purchased from the Government of Canada and manages various attractions, such as the CN Tower and the Old Port of Montréal (Exhibit 1). In these roles, the corporation aims to help create vibrant communities in an innovative and sustainable way and provide memorable guest experiences.

Exhibit 1—The corporation’s properties across Canada include both attractions and real estate

Source: Based on information from Canada Lands Company Limited

Exhibit 1—text version

This map of the Canadian provinces indicates where the corporation’s attractions and real estate are located:

- 2 real estate properties in Vancouver, British Columbia

- 1 real estate property in Calgary, Alberta

- 1 real estate property in Edmonton, Alberta

- 1 real estate property in Winnipeg, Manitoba

- 3 real estate properties and 2 attractions in the Greater Toronto Area, Ontario

- 4 real estate properties in Ottawa, Ontario

- 3 real estate properties and 2 attractions in Montréal and Longueuil in Quebec

- 1 real estate property in Dartmouth, Nova Scotia

- 1 real estate property in St. John’s, Newfoundland and Labrador

2. The corporation’s overarching objectives over the 5‑year period starting in April 2022 include the following:

- to deliver economic development opportunities and benefits to Canadians and municipalities

- to seek opportunities to enhance the corporation’s attractions to deliver innovative guest experiences

- to maintain and develop new partnerships with Indigenous communities

- to assist the government in delivering on key policy objectives relevant to its operations

3. Through letters of expectations, the Minister of Public Services and Procurement has also asked the corporation to deliver on priorities such as

- enhancing the diversity of bidders on government contracts; incorporating rigorous gender-based analysis plusDefinition 1 into planning, decision making, and program delivery; and fostering a corporate culture of diversity, equity, and inclusiveness

- ensuring the physical and psychological health and safety of employees

- purchasing goods and services with a reduced environmental impact and ensuring that operations and projects are environmentally sustainable and continue to exhibit environmental stewardship

- maximizing the amount of affordable housing included in development projects and working with Canada Mortgage and Housing Corporation and Public Services and Procurement Canada to improve affordable housing outcomes as part of the Federal Lands Initiative

- reporting on the corporation’s climate-related financial risks and collaborating among Crown corporations to build momentum and learn from others about adopting the recommendations of the Task Force on Climate-Related Financial DisclosuresDefinition 2

4. The corporation carries out its activities through its 3 subsidiaries:

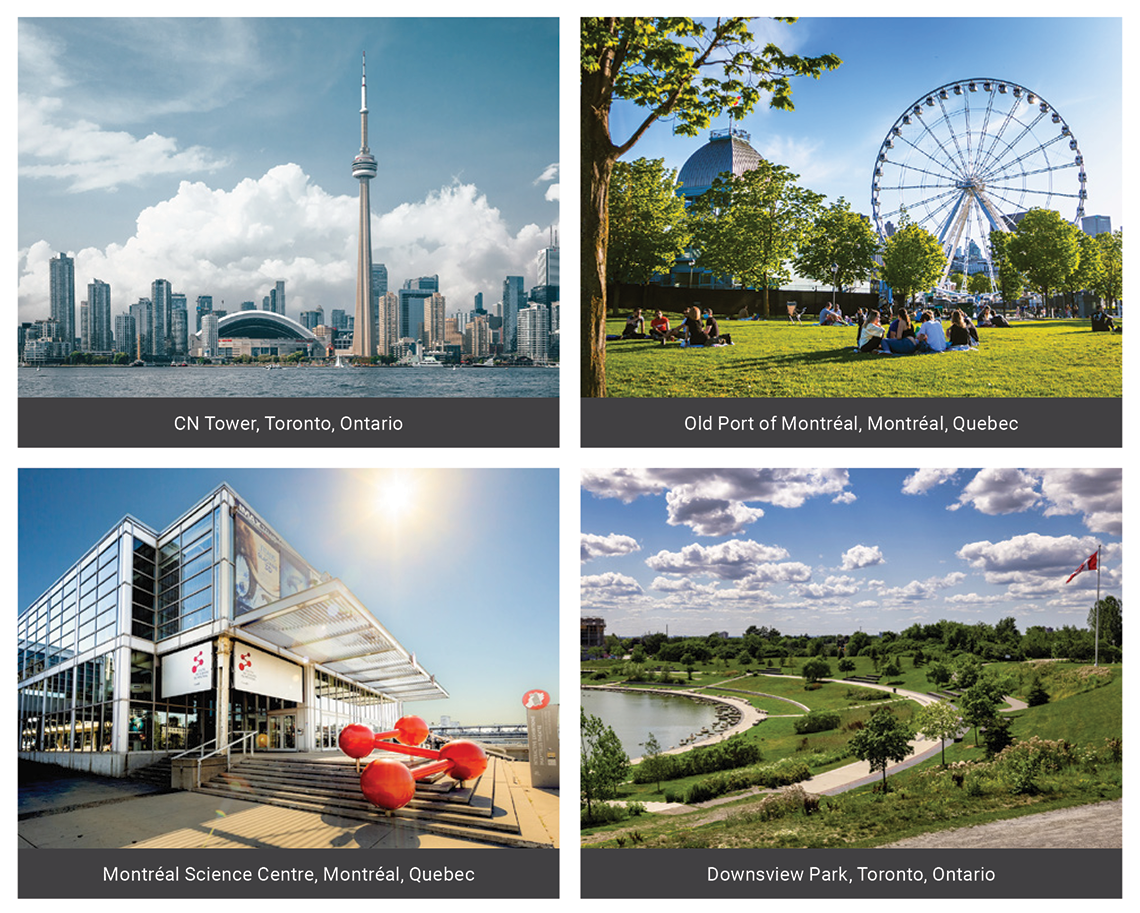

- Canada Lands Company CLC Limited ensures the commercially oriented and orderly development and sale of selected surplus real properties with best value to the Canadian taxpayer. It also holds and manages certain properties (such as the CN Tower). The subsidiary’s head office is in Toronto, Ontario, with operations across Canada.

- The Old Port of Montréal Corporation IncorporatedInc. has a mandate to develop and promote the Old Port of Montréal in Quebec and to administer and manage the property as an urban recreational, tourism, and cultural site. It is responsible for ensuring the maintenance of the quays and the land, buildings, equipment, and facilities on the site, including the Montréal Science Centre.

- Parc Downsview Park Inc. has a mandate to develop and manage most of the Downsview Park lands and buildings, which once belonged to the former Canadian Forces Base Toronto, as an urban recreational green space, to be held in perpetuity and in trust for the enjoyment of future generations.

5. The corporation employs a seasonal workforce and has employees throughout the country. As of 31 March 2023, the corporation employed 915 full‑time and part‑time employees, 426 of whom were unionized.

6. For the 2022–23 fiscal year, the corporation’s total revenue was $231 million (66% from attractions and 34% from real estate) and its net income before taxes was $39 million (50% from each of attractions and real estate). Capital investments amounted to $88 million. Total assets were $1.1 billion.

Focus of the audit

7. Our objective for this audit was to determine whether the systems and practices we selected for examination at Canada Lands Company Limited were providing the corporation with reasonable assurance that its assets were safeguarded and controlled, its resources were managed economically and efficiently, and its operations were carried out effectively, as required by section 138 of the Financial Administration Act.

8. In addition, section 139 of the Financial Administration Act requires that we state an opinion, with respect to the criteria established in subsection 138(3), on whether there was reasonable assurance that there were no significant deficiencies in the systems and practices we examined. We define and report significant deficiencies when, in our opinion, the corporation could be prevented from having reasonable assurance that its assets are safeguarded and controlled, its resources are managed economically and efficiently, and its operations are carried out effectively.

9. On the basis of our risk assessment, we selected systems and practices in the following areas:

The selected systems and practices, and the criteria used to assess them, are found in the exhibits throughout the report.

10. More details about the audit objective, scope, approach, and sources of criteria are in About the Audit at the end of this report.

Findings, Recommendations, and Responses

Corporate management practices

The corporation had good corporate management practices but needed improvement in some areas

11. We found that the corporation had good corporate management practices, but improvements were needed in some areas. Specifically, we found that the board did not receive some information—on compliance with laws and regulations and on non‑financial performance—that it needed to exercise its oversight role. We also found that the corporation’s strategic asset management framework was not consistently used by all teams across the corporation.

12. We also found that some of the corporation’s performance targets and indicators were not specific and measurable. We found that the corporation had not set out its risk appetite and risk tolerance levels to guide management decision making.

13. The analysis supporting this finding discusses the following topics:

14. The corporation is governed by its Board of Directors, which has 7 members, including the Chairperson. The boards of the subsidiaries have the same membership as the corporation’s board. However, the President and Chief Executive Officer of the corporation serves on the subsidiaries’ boards but not on the corporation’s board. The corporation reports to Parliament through the Minister of Public Services and Procurement.

15. The Chairperson and the President and Chief Executive Officer are appointed and their terms of office determined by the Governor in Council.Definition 3 The other directors are appointed by the Minister of Public Services and Procurement with the approval of the Governor in Council. The board has appointed itself as the boards of the subsidiaries and is responsible for appointing the President and Chief Executive Officer of each subsidiary.

16. The corporation’s board is supported by several committees: the Audit and Risk Committee, the Governance Committee, the Human Resources Committee, the Real Estate Committee, and the Attractions Committee, which are all committees of the whole.

17. In 2022, the board completed a strategic planning process that led to a new mission and vision and an expression of the core values of financial resilience, environmental sustainability, and social impact. To achieve its mandate, the corporation set out strategic priorities in its strategic plan for each of its key areas of focus:

- transform surplus and underutilized properties in its real estate business line

- create unique Canadian experiences in its attractions business line

- be a workplace of choice

18. The corporation had recently implemented a strategic asset management framework, with the objective of supporting management decision making in determining a strategy to optimize asset value and effectively achieve the corporation’s mandate and strategic objectives. This strategy takes into account financial and other targets and outcomes throughout the life cycle of assets, with a view to optimizing their overall contributions to stakeholders, such as the communities (including Indigenous groups) where the corporation manages attractions and develops and sells properties.

19. Moreover, during the period covered by the audit, the corporation was developing a comprehensive environmental, social, and governance program and planning the implementation of its newly developed strategic priorities. This includes the development of key performance indicators and targets.

20. The corporation faces both financial and non‑financial risks that, if not managed effectively, could significantly affect its ability to meet its corporate objectives. Examples of key risks include macroeconomic uncertainty (such as inflation, interest rates, and economic growth); talent attraction and retention; financial sustainability; health and safety risks; and environmental, social, and governance risks.

21. Management is responsible for implementing the corporation’s enterprise risk management framework; ensuring that relevant risks are properly identified, prioritized, and assessed; ensuring that appropriate mitigation activities are in place or are planned to manage risks to an acceptable level; instilling and maintaining a strong risk culture; and ensuring that risk monitoring and reporting is occurring.

22. Our recommendations in this area of examination appear at paragraphs 26, 32, 37, and 42.

23. Analysis. We found that the corporation had good systems and practices for corporate governance. However, improvement was needed in board oversight (Exhibit 2).

Exhibit 2—Corporate governance—Key findings and assessment

| Systems and practices | Criteria used | Key findings | Assessment against the criteria |

|---|---|---|---|

|

Board independence |

The board functioned independently. |

The board made decisions independently from management and held regular private meetings without management in attendance. Board members declared conflicts of interest before board meetings and recused themselves from discussions when there were potential conflicts of interest. |

Check mark in a green circle Met the criteria |

|

Providing strategic direction |

The board provided strategic direction. |

The board actively participated with management in setting strategic direction, which aligned with the corporation’s mandate. The board was active in setting the President and Chief Executive Officer’s annual objectives, which aligned with the corporation’s strategic direction and considered specific initiatives. The board conducted an annual assessment of the President and Chief Executive Officer’s performance. The corporation communicated regularly with the government and its stakeholders, which helped the board provide strategic direction to the corporation. |

Check mark in a green circle Met the criteria |

|

Board appointments and competencies |

The board collectively had the capacity and competencies to fulfill its responsibilities. |

The board communicated with its responsible minister about board appointments, renewals, and vacancies. The board determined the skills and expertise it needed to be effective and assessed whether its members had the appropriate skills and knowledge to carry out their responsibilities. The board solicited independent advice when necessary to fill gaps in its skills and expertise and to supplement its decision making. Board members were provided orientation sessions and ongoing training. |

Check mark in a green circle Met the criteria |

|

Board oversight |

The board carried out its oversight role over the corporation. |

The corporation’s internal audit function reported to the board’s Audit and Risk Committee, was independent of management, and helped the board exercise its oversight and monitoring responsibilities. The corporation monitored compliance with its Code of Conduct and Conflict of Interest Policy. Exceptions were reported to the board and addressed appropriately. Weaknesses The board did not receive from management a statement of compliance encompassing laws, regulations, and municipal bylaws that posed a significant risk to its operations. The board did not receive from management clear and complete non‑financial performance information related to corporate objectives to monitor progress toward the corporation’s strategic priorities (this weakness is discussed in paragraphs 33 to 35). |

Exclamation point in a yellow circle Met the criteria, with improvement needed |

|

Legend—Assessment against the criteria Check mark in a green circle Met the criteria Exclamation point in a yellow circle Met the criteria, with improvement needed An X in a red circle Did not meet the criteria |

|||

24. Weakness—Board oversight. The board was kept informed of its legal obligations and regularly received updates on legislation that was key to the corporation’s operations, such as the Official Languages Act; the Financial Administration Act; the Canada Business Corporations Act; the Employment Equity Act; and various federal, provincial, and municipal laws relating to environmental matters. However, we found that the board did not receive from management a statement of compliance encompassing laws, regulations, and municipal bylaws that, if not complied with, could pose a significant risk to the corporation’s operations.

25. This weakness matters because the board is responsible for overseeing the management of the business, activities, and other affairs of the corporation and for ensuring that the corporation operates in accordance with applicable laws, regulations, and municipal bylaws. A report on compliance with laws and regulations is a key element of accountability that would provide assurance to the board that immediate action is not needed.

26. Recommendation. At least once a year, the corporation’s management should provide the board with a statement that includes accurate and complete information about the status of the compliance of the corporation and its subsidiaries with laws and regulations that pose a significant risk to their operations.

The corporation’s response. Agreed. Commencing in February 2024, management will provide the board with an annual statement regarding the compliance of the corporation and its subsidiaries with laws and regulations that are key to its operations.

27. Analysis. We found that the corporation had good systems and practices for strategic planning. However, improvements were needed in asset optimization and in performance measurement, monitoring, and reporting (Exhibit 3).

Exhibit 3—Strategic planning—Key findings and assessment

| Systems and practices | Criteria used | Key findings | Assessment against the criteria |

|---|---|---|---|

|

Strategic planning |

The corporation established a strategic plan and strategic objectives that aligned with its mandate. |

The corporation had a systematic strategic planning process in place, which included analyzing its internal and external environment, strengths, weaknesses, opportunities, and key risks and threats. It consulted with external stakeholders when preparing its strategic priorities. The corporation established strategic objectives that aligned with its mandate and the government’s priorities. The corporation communicated strategic information to employees through the performance objectives set for management and internal business performance targets. The corporation had a succession plan and a mandatory training program and included training and development needs in its performance management review process. |

Check mark in a green circle Met the criteria |

|

Asset optimization |

The corporation established a strategic asset management framework that informed the utilization of its real property to ensure the best value for its stakeholders. |

During the 2021–22 fiscal year, the corporation developed a strategic asset management framework that aligned with its strategic priorities and addressed the fundamentals of asset management, including value, alignment, leadership, risk, and monitoring. Weaknesses The corporation’s strategic asset management process was not fully documented. No specific policy or guidelines were in place for the corporation’s strategic asset management framework, nor was the framework used consistently. |

Exclamation point in a yellow circle Met the criteria, with improvement needed |

|

Performance measurement, monitoring, and reporting |

The corporation established performance indicators in support of achieving its strategic objectives and monitored and reported on its progress against these indicators. |

The corporation established quantitative and qualitative performance indicators for its corporate objectives, including environmental, social, and governance objectives. These were available to management, the board, and the public. The corporation assigned an owner responsible for achieving each of its strategic priorities—including its environmental, social, and governance objectives—and established expected outcomes for them. The corporation’s reports contained information on progress made toward overall expected outcomes. Both management and the board used performance information to support decision making. Weaknesses The corporation had no concise and consistent process to monitor, report, and comment on progress made toward its strategic priorities. Several of the corporation’s performance indicators were not specific or measurable. |

Exclamation point in a yellow circle Met the criteria, with improvement needed |

|

Legend—Assessment against the criteria Check mark in a green circle Met the criteria Exclamation point in a yellow circle Met the criteria, with improvement needed An X in a red circle Did not meet the criteria |

|||

28. Weaknesses—Asset optimization. We found that the corporation had not fully documented its strategic asset management process. For example, a process description of the corporation’s end‑to‑end strategic asset management practices was not in place.

29. Strategic asset management involves a systematic and strategic approach to the balancing of costs, risks, opportunities, and performance benefits of assets over their life cycles—in terms of achieving the corporation’s organizational objectives and taking into account the needs and expectations of stakeholders. We found that the corporation had incorporated these relevant aspects into its strategic asset management framework, a tool to help the corporation evaluate its strategic approach for any given asset. This evaluation included assigning relative weights to the criteria it had determined (such as financial results and community benefits) and assessing opportunities against the criteria in order to determine which opportunity would lead to optimal value. The strategic approach would then inform the ongoing operation and maintenance of assets.

30. We found that despite the lack of documentation, the corporation’s Real Estate and Attractions divisions did understand the high‑level process. However, we also found that the corporation did not have a policy or guidelines to support the implementation of the framework and that the framework was not consistently applied by all teams within the Real Estate and Attractions divisions. For example, 1 team modified the approach used to evaluate individual assets, but this meant that some evaluation criteria were not applied in the same way to other assets by other teams. Likewise, without a policy or guidelines, individual teams might not know under what conditions the strategic approach for an asset should be re‑evaluated.

31. These weaknesses matter because clear documentation of the strategic asset management process, including a policy and guidelines for the strategic asset management framework, would support consistent implementation of a strategy for the corporation’s assets that would help to ensure that optimal value is derived from them over their life cycles. Ensuring that the strategic asset management framework is used consistently across the corporation, for initial asset evaluation and then for regular reassessment at appropriate intervals, would support a more rigorous and transparent corporation‑wide approach to asset management.

32. Recommendation. The corporation should fully document its strategic asset management process and develop a policy and guidelines to ensure consistent implementation of its strategic asset management framework.

The corporation’s response. Agreed. Management has begun taking steps to address this recommendation. At the September 2023 board meeting, the corporation’s Strategic Asset Management Policy was approved by the board. The policy sets out principles, guidelines, and responsibilities for strategic asset management. It also directs the development and regular review of the corporate Strategic Asset Management Plan and end‑to‑end documentation of the strategic asset management framework implementation and review. An update on this work will be provided to the board at the November 2023 meeting, with completion of the Strategic Asset Management Plan with end‑to‑end documentation expected by 31 March 2024.

33. Weaknesses—Performance measurement, monitoring, and reporting. We found that the performance information reported to the board was not always presented in a clear and concise manner. In some cases, the information was not presented in terms of the performance indicator or target established during the strategic planning process. For example, some non‑financial objectives—such as incorporating planned green spaces across projects and through investments—were reported at the project level and not summarized at a corporate level, which made it difficult for the board to assess overall performance against corporate objectives.

34. We also found that several performance indicators were not specific or measurable. For example, an indicator related to working with a First Nation on shared infrastructure efforts stated only that the corporation should continue the planning process. Continuing the planning process was not specific and did not have a measurable target for the board to assess progress against desired outcomes.

35. These weaknesses matter because improving how the corporation measures its performance would allow it to better assess progress toward achieving corporate objectives and strategic priorities. Furthermore, clearly reporting to the board on the corporation’s performance against its indicators and targets would strengthen board oversight, allowing the board to consider in a timely manner whether additional actions or monitoring were needed for the corporation to achieve its objectives.

36. Nonetheless, we found that the corporation monitored key activities and deliverables related to its corporate objectives, including environmental, social, and governance objectives, and reported to the board on their completion in a timely manner. This reporting allowed the board to monitor general progress against objectives set in the corporate plan.

37. Recommendation. The corporation should develop specific and measurable performance indicators and establish targets that would allow it to measure and monitor the results achieved against non‑financial corporate objectives and strategic priorities. Furthermore, the corporation should establish a clear and consistent reporting process that summarizes its key performance indicators and established targets and reports the results achieved against those indicators at a corporate level to the board.

The corporation’s response. Agreed. The corporation developed a new strategic plan for 2023–28 in June 2022. To support the implementation of the strategic plan, in September 2023 the corporation finalized ambitions, key performance indicators, targets, and strategic initiatives for each of the priorities and values within the plan. The key performance indicators and targets are specific, measurable, and time‑bound, where appropriate. As part of the implementation, the corporation has developed a reporting process for its key performance indicators and targets, which will include a reporting dashboard and reporting frequency intervals to the board. The corporation will implement reporting against its key performance indicators and targets to the board in the 2023–24 fiscal year and include targets and key performance indicators, where appropriate, in its 2024–25 to 2028–29 corporate plan and its 2023–24 annual report.

38. Analysis. We found that the corporation had good systems and practices for corporate risk management. However, an improvement was needed in risk assessment (Exhibit 4).

Exhibit 4—Corporate risk management—Key findings and assessment

| Systems and practices | Criteria used | Key findings | Assessment against the criteria |

|---|---|---|---|

|

Risk identification and assessment |

The corporation identified and assessed risks to achieving its strategic objectives. |

The corporation identified its strategic and operational risks, which it assessed according to their likelihood of occurrence and potential impact. The corporation updated its identified risks yearly by conducting surveys of key individuals. The corporation’s enterprise risk management program took into account environmental, sustainable development, social, governance, and climate change risks. Weakness The corporation did not set its risk appetite and risk tolerance levels to guide decision making. |

Exclamation point in a yellow circle Met the criteria, with improvement needed |

|

Risk mitigation |

The corporation defined and implemented risk mitigation measures. |

The corporation developed mitigation action plans and identified owners for its corporate risks, including environmental, sustainable development, social, governance, and climate change risks. The corporation’s human resource plans addressed relevant key risks and opportunities and established appropriate roles, responsibilities, and resource requirements. |

Check mark in a green circle Met the criteria |

|

Risk monitoring and reporting |

The corporation monitored and reported on the implementation of risk mitigation measures. |

The corporation reported on risk management activities through detailed quarterly reports to the board. These risk reports included a description of key risks the corporation faced, residual risk ratings and trends, new and emerging issues, and significant risk events. The management of risks contributed to adjustments to the strategic direction, priority setting, and operations of the corporation. |

Check mark in a green circle Met the criteria |

|

Legend—Assessment against the criteria Check mark in a green circle Met the criteria Exclamation point in a yellow circle Met the criteria, with improvement needed An X in a red circle Did not meet the criteria |

|||

39. Weakness—Risk assessment. We found that the corporation did not set its risk appetite and risk tolerance levels.

40. Risk appetite is the amount and type of risk that the corporation is prepared to accept in order to meet its corporate objectives and strategic priorities. Risk tolerance level, typically communicated in quantitative terms, is the willingness of an organization to accept a particular level of residual risk in relation to its risk appetite.

41. This weakness matters because risk appetite and risk tolerance levels can guide decision making and help an organization identify risks that require additional mitigation measures or monitoring.

42. Recommendation. The corporation should set its risk appetite and risk tolerance levels.

The corporation’s response. Agreed. The corporation’s enterprise risk management program and its risk management policies and procedures identify, manage, and mitigate its risks, aiming to maintain an appropriate balance between risk taking and risk aversion. The corporation has a variety of activities around risk governance, risk reporting, and risk management embedded into its program to aid in decision making and its efficient and effective risk mitigation strategies. The corporation performs an annual risk refresh, where key risks are identified, inherent and residual risk is assessed, and additional mitigation actions are identified, where applicable. Risk reporting is embedded into board reporting, business plans, and various other reporting performed.

Formally setting and documenting the corporation’s risk appetite and risk tolerance levels, using both qualitative and quantitative measures, where appropriate, will further help in its decision making and its risk mitigation efforts. The corporation will set and document these by the end of the 2024 calendar year.

Management of operations

The corporation had good practices for managing its operations, but an improvement was needed in attractions planning

43. We found that the corporation generally had good practices for managing its operations in both attractions and real estate management—and in managing environmental and sustainable development matters. However, we found that important information was missing from business plans for individual attractions.

44. The analysis supporting this finding discusses the following topics:

45. The corporation has 2 operating business lines: real estate and attractions, each of which has its own division. The corporation views environmental, social, and governance pillars as integral to its management of the corporation.

46. Through its Real Estate division, the corporation purchases surplus properties from federal departments and agencies and reintegrates them into local communities through real estate development, leasing, and sales (Exhibit 5). In doing so, the corporation considers environmental issues and the views of affected communities, Indigenous peoples, and other levels of government.

Exhibit 5—The corporation owns and develops a variety of real estate properties across Canada

Images: Canada Lands Company Limited

Exhibit 5—text version

This collage shows a rendering of the Jericho Lands in Vancouver, British Columbia, a picture of the Village at Griesbach in Edmonton, Alberta, a picture of Shannon Park in Dartmouth, Nova Scotia, and a picture of Wateridge Village in Ottawa, Ontario.

47. The corporation seeks input from these various stakeholders to inform development plans for its real estate assets. It then manages the implementation of those plans from acquisition and development to asset disposal—that is, the sale of the property. The corporation relies on contractors and consultants to complete much of the development work, but it provides management oversight to ensure that plans are implemented as intended. This also includes obtaining municipal approvals, where needed, throughout development.

48. Given that the life cycle for property acquisition, planning, development, and sales can take many years, the corporation sometimes seeks alternative uses for properties in the interim period.

49. Through its Attractions division, the corporation holds, improves, and manages world‑renowned attractions: the CN Tower and Downsview Park in Toronto and the Old Port of Montréal and the Montréal Science Centre in Montréal (Exhibit 6). The success of these attractions depends on the performance of the tourism sectors in Toronto and Montréal, along with other factors. For example, the number of visitors to the CN Tower depends on the seasons and daily weather conditions.

Exhibit 6—The corporation owns and operates 4 attractions in Ontario and Quebec

Photos: Canada Lands Company Limited

Exhibit 6—text version

This collage shows pictures of the CN Tower and Downsview Park in Toronto, Ontario, and the Old Port of Montréal and the Montréal Science Centre in Montréal, Quebec.

50. In March 2022, the corporation began a process to assess and formalize its environmental, social, and governance program. This included adoption and implementation of the recommendations of the Task Force on Climate-Related Financial Disclosures. The corporation aimed to align the scope of this work with its strategic plan, which identified many environmental and sustainable development elements within its strategic priorities.

51. Our recommendation in this area of examination appears at paragraph 56.

52. Analysis. We found that the corporation had good practices in real estate planning, operations, and performance measurement, monitoring, and reporting (Exhibit 7).

Exhibit 7—Real estate—Key findings and assessment

| Systems and practices | Criteria used | Key findings | Assessment against the criteria |

|---|---|---|---|

|

Real estate planning |

The corporation developed an operating plan that aligned with its strategic objectives. |

The corporation’s real estate plans aligned with its mandate and strategic objectives. The corporation’s real estate planning process included establishing financial budgets updated biannually and quarterly tracking of progress. It also considered non‑financial matters related to the community and the environment. Within job descriptions, the corporation established roles, responsibilities, and accountabilities related to real estate plans. It also established performance objectives for individual managers around objectives set out in operational plans and budgets. The real estate planning process took into account risk and environmental requirements in setting priorities and allocating resources. The corporation explicitly assigned operational risks to risk owners and developed and monitored mitigation plans. Through stakeholder engagement, the corporation collaborated to identify expectations for quantity, quality, and level of service. Real estate projects were approved according to delegated authorities and executed following an established process. Operational plans included clear deliverables, timelines, budgets, risk assessments, and performance indicators and targets that aligned with corporate objectives and were communicated throughout the corporation. Through its partnerships, the corporation demonstrated its commitment to affordable housing, in keeping with the government’s priorities. |

Check mark in a green circle Met the criteria |

|

Real estate operations |

The corporation managed its real estate operations in a manner that ensured that its real property was acquired, developed, and disposed of in a fair, open, and transparent manner and that ensured its financial sustainability. |

The corporation managed the acquisition, development, and disposal of real property in accordance with its documented process. The corporation’s acquisition decisions took into account financial performance, community interests, environmental concerns, and regulatory compliance. The corporation’s acquisitions were made at appraised fair market value and established accountability for environmental liabilities. At the pre‑development stage, the corporation demonstrated that it had engaged with the public, addressed community concerns, properly approved significant amendments to plans, and created value. At the development stage, the corporation demonstrated that it had leveraged pre‑development plans; arranged demolition, servicing, and other pertinent contracts with due process; negotiated and executed infrastructure agreements; and completed final inspection of site servicing. At the marketing and sales stage, the corporation demonstrated that it had updated appraisal information, created marketing plans, selected a sales agent or broker with due process, completed property documentation, and assessed whether sales objectives were achieved. The corporation had a process to ensure that its development plans and conceptual designs were implemented and that final inspections of site construction were conducted. |

Check mark in a green circle Met the criteria |

|

Performance measurement, monitoring, and reporting |

The corporation established performance indicators to measure the operational performance of its real estate operations and monitored and reported on progress. |

Timely board and management reviews of real estate results and activities ensured that results were monitored and reported against established performance indicators and targets, variances were explained, and changes in processes and plans took place as needed. The corporation conducted independent assessments of its real estate operations, evaluated the delivery of projects against plans and budgets, and assessed the relevance of its real estate results accordingly. |

Check mark in a green circle Met the criteria |

|

Legend—Assessment against the criteria Check mark in a green circle Met the criteria Exclamation point in a yellow circle Met the criteria, with improvement needed An X in a red circle Did not meet the criteria |

|||

53. Analysis. We found that the corporation had good systems and practices for managing its attractions. However, an improvement was needed in attractions planning (Exhibit 8).

Exhibit 8—Attractions—Key findings and assessment

| Systems and practices | Criteria used | Key findings | Assessment against the criteria |

|---|---|---|---|

|

Attractions planning |

The corporation developed operating plans that aligned with its strategic objectives. |

Operational plans addressed key elements, including setting objectives through consultations with external stakeholders, performance indicators and targets that aligned with corporate objectives, budgets and estimates of the resources needed, key activities or programs to be delivered, time horizons, and actions required to address risks. Risk management processes considered key risks, such as those related to talent attraction and retention, health and safety, and the environment and sustainable development. The corporation assigned these risks to risk owners, who monitored the effects of mitigation strategies, reported any significant changes, and took actions when needed. The corporation measured performance of individual management staff through indicators linked to operational objectives and budgets. Weakness Business plans for individual attractions presented to the corporation’s executive management team were missing important information. |

Exclamation point in a yellow circle Met the criteria, with improvement needed |

|

Attractions operations |

The corporation implemented its operating plans to deliver expected results. |

The corporation implemented operating plans and managed program costs to ensure that operational objectives were achieved within budget constraints. The corporation aligned marketing plans with program objectives and monitored them. The corporation’s Attractions division provided learning, training, and development to its staff in accordance with its policies and the staff members’ roles and responsibilities. |

Check mark in a green circle Met the criteria |

|

Performance measurement, monitoring, and reporting |

The corporation established performance indicators to measure the operational performance of its attractions and monitored and reported on progress. |

The corporation’s Attractions division monitored and reported operational results against performance indicators and targets, using a wide variety of reporting tools. Performance indicators were focused on revenue and attendance and took into account visitor expectations and experiences. The corporation evaluated variances between planned and actual results and explained them in quarterly reports to management and the board. Changes to processes and plans were implemented as needed. The corporation’s Attractions division evaluated its operations through independent assessments, such as client surveys, benchmarking activities, trend analysis, and internal audits. It also assessed program service delivery regularly and reported results to relevant stakeholders. |

Check mark in a green circle Met the criteria |

|

Legend—Assessment against the criteria Check mark in a green circle Met the criteria Exclamation point in a yellow circle Met the criteria, with improvement needed An X in a red circle Did not meet the criteria |

|||

54. Weakness—Attractions planning. Each of the corporation’s attractions had a structured operational planning process, which informed and rolled up into the corporate plans. The processes included the preparation of business plans that included key elements such as business objectives, overviews of activities or programs to be delivered, summary budgets, and actions to address risks. These business plans were presented to the corporation’s executive management team as part of the corporate‑wide planning process. We found that these business plans were missing important information such as

- prioritized mitigation strategies related to corporate‑level risks, resources allocated to these, and their effectiveness at the business‑unit level

- links between visitor expectations and specific operational objectives to improve visitor experiences

- links between planned operational activities and non‑financial performance expectations—for example, specifying which planned operational activities linked to demonstrating environmental leadership

55. This weakness matters because it is important for executive management to have a complete and clear picture of individual attractions’ business plans in order to ensure alignment with the overall corporate strategy and identify any areas for adjustment.

56. Recommendation. The corporation should ensure that its business plans demonstrate how operational and corporate objectives align, link identified risks to mitigation strategies, and link visitor expectations and non‑financial performance targets to operational objectives.

The corporation’s response. Agreed. The business plans of the corporation, including those for each of its attractions, are important tools in the strategic, operational, and budget processes. These business plans are used to aid in setting direction, objectives, and financial targets. The corporation will add an update to each of the attractions’ business plans in March or April 2024 (and each year thereafter) to demonstrate their mitigation strategies related to key risks and add details that show the links between operational activities and non‑financial performance, such as environmental initiatives.

57. Analysis. We found that the corporation had good systems and practices for managing environmental and sustainable development matters (Exhibit 9).

Exhibit 9—Environment and sustainable development—Key findings and assessment

| Systems and practices | Criteria used | Key findings | Assessment against the criteria |

|---|---|---|---|

|

Environment and sustainable development management practices |

The corporation had environmental and sustainable development management practices. |

The corporation’s environmental and sustainable development management practices were based on policy statements and legal requirements and were subject to various review and approval processes. These processes were based on applicable municipal, provincial, and federal standards. The board and its committees provided strategic direction over the environmental and sustainable development practices in place. The corporation established and approved appropriate roles, responsibilities, authorities, accountabilities, and resources. The corporation developed targets, objectives, and action plans at the corporate level and in the real estate and attractions business lines in support of its commitments to the Greening Government Strategy. |

Check mark in a green circle Met the criteria |

|

Monitoring and reporting |

The corporation monitored and reported to the board and the public on the implementation of environmental and sustainable development management practices. |

The corporation’s performance measurement process for environmental and sustainable development matters included the assignment of roles, responsibilities, and resources; the setting of targets; and the identification of corrective actions when targets were not being met. The corporation reported its environmental and sustainable development performance through its annual report, its corporate social responsibility report, and its corporate plan summary. |

Check mark in a green circle Met the criteria |

|

Legend—Assessment against the criteria Check mark in a green circle Met the criteria Exclamation point in a yellow circle Met the criteria, with improvement needed An X in a red circle Did not meet the criteria |

|||

Conclusion

58. In our opinion, on the basis of the criteria established, there was reasonable assurance that there were no significant deficiencies in the corporation’s systems and practices we examined. We concluded that Canada Lands Company Limited maintained its systems and practices during the period covered by the audit in a manner that provided the reasonable assurance required under section 138 of the Financial Administration Act.

About the Audit

This independent assurance report was prepared by the Office of the Auditor General of Canada on Canada Lands Company Limited. Our responsibility was to express

- an opinion on whether there was reasonable assurance that during the period covered by the audit, there were no significant deficiencies in the corporation’s systems and practices we selected for examination

- a conclusion about whether the corporation complied in all significant respects with the applicable criteria

Under section 131 of the Financial Administration Act, the corporation is required to maintain financial and management control and information systems and management practices that provide reasonable assurance of the following:

- Its assets are safeguarded and controlled.

- Its financial, human, and physical resources are managed economically and efficiently.

- Its operations are carried out effectively.

In addition, section 138 of the act requires the corporation to have a special examination of these systems and practices carried out at least once every 10 years.

All work in this audit was performed to a reasonable level of assurance in accordance with the Canadian Standard on Assurance Engagements (CSAE) 3001—Direct Engagements, set out by the Chartered Professional Accountants of Canada (CPA Canada) in the CPA Canada Handbook—Assurance.

The Office of the Auditor General of Canada applies the Canadian Standard on Quality Management 1—Quality Management for Firms that Perform Audits or Reviews of Financial Statements, or Other Assurance or Related Services Engagements. This standard requires our office to design, implement, and operate a system of quality management, including policies or procedures regarding compliance with ethical requirements, professional standards, and applicable legal and regulatory requirements.

In conducting the audit work, we complied with the independence and other ethical requirements of the relevant rules of professional conduct applicable to the practice of public accounting in Canada, which are founded on fundamental principles of integrity, objectivity, professional competence and due care, confidentiality, and professional behaviour.

In accordance with our regular audit process, we obtained the following from the corporation:

- confirmation of management’s responsibility for the subject under audit

- acknowledgement of the suitability of the criteria used in the audit

- confirmation that all known information that has been requested, or that could affect the findings or audit conclusion, has been provided

- confirmation that the audit report is factually accurate

Audit objective

The objective of this audit was to determine whether the systems and practices we selected for examination at Canada Lands Company Limited were providing the corporation with reasonable assurance that its assets were safeguarded and controlled, its resources were managed economically and efficiently, and its operations were carried out effectively, as required by section 138 of the Financial Administration Act.

Scope and approach

Our audit work examined Canada Lands Company Limited and its subsidiaries. The scope of the special examination was based on our assessment of the risks the corporation faced that could affect its ability to meet the requirements set out by the Financial Administration Act.

The systems and practices selected for examination for each area of the audit are found in the exhibits throughout the report.

In carrying out the special examination, we reviewed key documents related to the systems and practices selected for examination. We interviewed members of the Board of Directors, senior management, employees of the corporation and its subsidiaries, and Public Services and Procurement Canada officials. We tested the corporation’s systems and practices to obtain the required level of audit assurance. Our testing sometimes included detailed sampling. For example, we selected samples on the basis of auditors’ judgment in corporate governance, strategic planning, corporate risk management, and real estate operations.

In carrying out the special examination, we relied on an internal audit of strategic asset management.

Sources of criteria

The criteria used to assess the systems and practices selected for examination are found in the exhibits throughout the report.

Corporate governance

Internal Control—Integrated Framework, Committee of Sponsoring Organizations of the Treadway Commission, 2013

Practice Guide: Assessing Organizational Governance in the Public Sector, The Institute of Internal Auditors, 2014

General bylaws of Canada Lands Company Limited and its subsidiaries

Charter of the Board of Directors and terms of reference of its committees, Canada Lands Company Limited

Strategic planning

Financial Administration Act

Recommended Practice Guideline 3, Reporting Service Performance Information, International Public Sector Accounting Standards Board, 2015

Guidance for Crown Corporations on Preparing Corporate Plans and Budgets, Treasury Board of Canada Secretariat, 2019

Asset Management—An Anatomy, Version 3, The Institute of Asset Management, 2015

International Organization for StandardizationISO 55000—Asset Management—Overview, Principles and Terminology, International Organization for Standardization, 2014

ISO 55001—Asset Management—Management Systems—Requirements, International Organization for Standardization, 2014

ISO 55002—Asset Management—Management Systems—Guidelines for the Application of ISO 55001, International Organization for Standardization, 2018

Corporate risk management

Enterprise Risk Management—Integrating with Strategy and Performance: Executive Summary, Committee of Sponsoring Organizations of the Treadway Commission, 2017

ISO 31000—Risk Management—Guidelines, International Organization for Standardization, 2018

Internal Control—Integrated Framework, Committee of Sponsoring Organizations of the Treadway Commission, 2013

Enterprise Risk Management Framework, Canada Lands Company Limited, 2021

Real estate management

Policy on the Planning and Management of Investments, Treasury Board, 2021

Directive on the Management of Real Property, Treasury Board, 2021

Guide to the Management of Real Property, Treasury Board of Canada Secretariat, 2021

Asset Management—An Anatomy, Version 3, The Institute of Asset Management, 2015

Internal Control—Integrated Framework, Committee of Sponsoring Organizations of the Treadway Commission, 2013

A Guide to the Project Management Body of Knowledge (PMBOK® Guide), Sixth Edition, Project Management Institute IncorporatedInc., 2017

ISO 55000—Asset Management—Overview, Principles and Terminology, International Organization for Standardization, 2014

ISO 55001—Asset Management—Management Systems—Requirements, International Organization for Standardization, 2014

ISO 55002—Asset Management—Management Systems—Guidelines for the Application of ISO 55001, International Organization for Standardization, 2018

Transforming Our World: The 2030 Agenda for Sustainable Development, United Nations, 2015

Attractions management

Internal Control—Integrated Framework, Committee of Sponsoring Organizations of the Treadway Commission, 2013

Plan-Do-Check-Act management model adapted from the Deming Cycle

Transforming our World: The 2030 Agenda for Sustainable Development, United Nations, 2015

ISO 55000—Asset Management—Overview, Principles and Terminology, International Organization for Standardization, 2014

ISO 55001—Asset Management—Management Systems—Requirements, International Organization for Standardization, 2014

ISO 55002—Asset Management—Management Systems—Guidelines for the Application of ISO 55001, International Organization for Standardization, 2018

Environment and sustainable development

ISO 14001—Environmental Management Systems, International Organization for Standardization, 2015

Greening Government Strategy: A Government of Canada Directive, Treasury Board of Canada Secretariat, 2020

Implementing the Recommendations of the Task Force on Climate-Related Financial Disclosures, Task Force on Climate-Related Financial Disclosures, 2021

Transforming our World: The 2030 Agenda for Sustainable Development, United Nations, 2015

ISO 26000—Guidance on Social Responsibility, International Organization for Standardization, 2010

Period covered by the audit

The special examination covered the period from 27 June 2022 to 23 May 2023. This is the period to which the audit conclusion applies. However, to gain a more complete understanding of the significant systems and practices, we also examined certain matters that preceded the start date of this period.

Date of the report

We obtained sufficient and appropriate audit evidence on which to base our conclusion on 15 November 2023, in Ottawa, Canada.

Audit team

This special examination was completed by a multidisciplinary team from across the Office of the Auditor General of Canada led by Heather McManaman, Principal. The principal has overall responsibility for audit quality, including conducting the audit in accordance with professional standards, applicable legal and regulatory requirements, and the office’s policies and system of quality management.

List of Recommendations

The following table lists the recommendations and responses found in this report. The paragraph number preceding the recommendation indicates the location of the recommendation in the report.

| Recommendation | Response |

|---|---|

|

26. At least once a year, the corporation’s management should provide the board with a statement that includes accurate and complete information about the status of the compliance of the corporation and its subsidiaries with laws and regulations that pose a significant risk to their operations. |

The corporation’s response. Agreed. Commencing in February 2024, management will provide the board with an annual statement regarding the compliance of the corporation and its subsidiaries with laws and regulations that are key to its operations. |

|

32. The corporation should fully document its strategic asset management process and develop a policy and guidelines to ensure consistent implementation of its strategic asset management framework. |

The corporation’s response. Agreed. Management has begun taking steps to address this recommendation. At the September 2023 board meeting, the corporation’s Strategic Asset Management Policy was approved by the board. The policy sets out principles, guidelines, and responsibilities for strategic asset management. It also directs the development and regular review of a corporate Strategic Asset Management Plan and end‑to‑end documentation of the strategic asset management framework implementation and review. An update on this work will be provided to the board at the November 2023 meeting, with completion of the Strategic Asset Management Plan with end‑to‑end documentation expected by 31 March 2024. |

|

37. The corporation should develop specific and measurable performance indicators and establish targets that would allow it to measure and monitor the results achieved against non‑financial corporate objectives and strategic priorities. Furthermore, the corporation should establish a clear and consistent reporting process that summarizes its key performance indicators and established targets and reports the results achieved against those indicators at a corporate level to the board. |

The corporation’s response. Agreed. The corporation developed a new strategic plan for 2023–28 in June 2022. To support the implementation of the strategic plan, in September 2023 the corporation finalized ambitions, key performance indicators, targets, and strategic initiatives for each of the priorities and values within the plan. The key performance indicators and targets are specific, measurable, and time‑bound, where appropriate. As part of the implementation, the corporation has developed a reporting process for its key performance indicators and targets, which will include a reporting dashboard and reporting frequency intervals to the board. The corporation will implement reporting against its key performance indicators and targets to the board in the 2023–24 fiscal year and include targets and key performance indicators, where appropriate, in its 2024–25 to 2028–29 corporate plan and its 2023–24 annual report. |

|

42. The corporation should set its risk appetite and risk tolerance levels. |

The corporation’s response. Agreed. The corporation’s enterprise risk management program and its risk management policies and procedures identify, manage, and mitigate its risks, aiming to maintain an appropriate balance between risk taking and risk aversion. The corporation has a variety of activities around risk governance, risk reporting, and risk management embedded into its program to aid in decision making and its efficient and effective risk mitigation strategies. The corporation performs an annual risk refresh, where key risks are identified, inherent and residual risk is assessed, and additional mitigation actions are identified, where applicable. Risk reporting is embedded into board reporting, business plans, and various other reporting performed. Formally setting and documenting the corporation’s risk appetite and risk tolerance levels, using both qualitative and quantitative measures, where appropriate, will further help in its decision making and its risk mitigation efforts. The corporation will set and document these by the end of the 2024 calendar year. |

|

56. The corporation should ensure that its business plans demonstrate how operational and corporate objectives align, link identified risks to mitigation strategies, and link visitor expectations and non‑financial performance targets to operational objectives. |

The corporation’s response. Agreed. The business plans of the corporation, including those for each of its attractions, are important tools in the strategic, operational, and budget processes. These business plans are used to aid in setting direction, objectives, and financial targets. The corporation will add an update to each of the attractions’ business plans in March or April 2024 (and each year thereafter) to demonstrate their mitigation strategies related to key risks and add details that show the links between operational activities and non‑financial performance, such as environmental initiatives. |